Why is Pharma Reducing Insulin Prices?

Don't think I forgot about PBMs

There has been a lot of news recently around changes to insulin pricing. For years, advocates have been fighting to get insulin prices reduced so that people who really need insulin can afford it and don’t have to resort to methods like rationing.

The big three players in the space, Sanofi, Eli Lilly, and Novo Nordisk, recently all announced that they will be reducing their insulin prices and capping payments for individuals. There is a lot of nuance here (in terms of which types of insulin get reduced by how much, what happens if you don’t have insurance, etc. etc.), but don’t worry we’ll dive into all of it.

It’s also important to note that advocacy made this issue more visible and played a role in legislation, but the inciting factor that led the “Big Three” to do this now is a combination of impact from both the Inflation Reduction Act and the American Rescue Plan. It’s a little wonky but worth it to understand the details to get the full picture of what is going on.

What Type of Insulin is Going Down in Price?

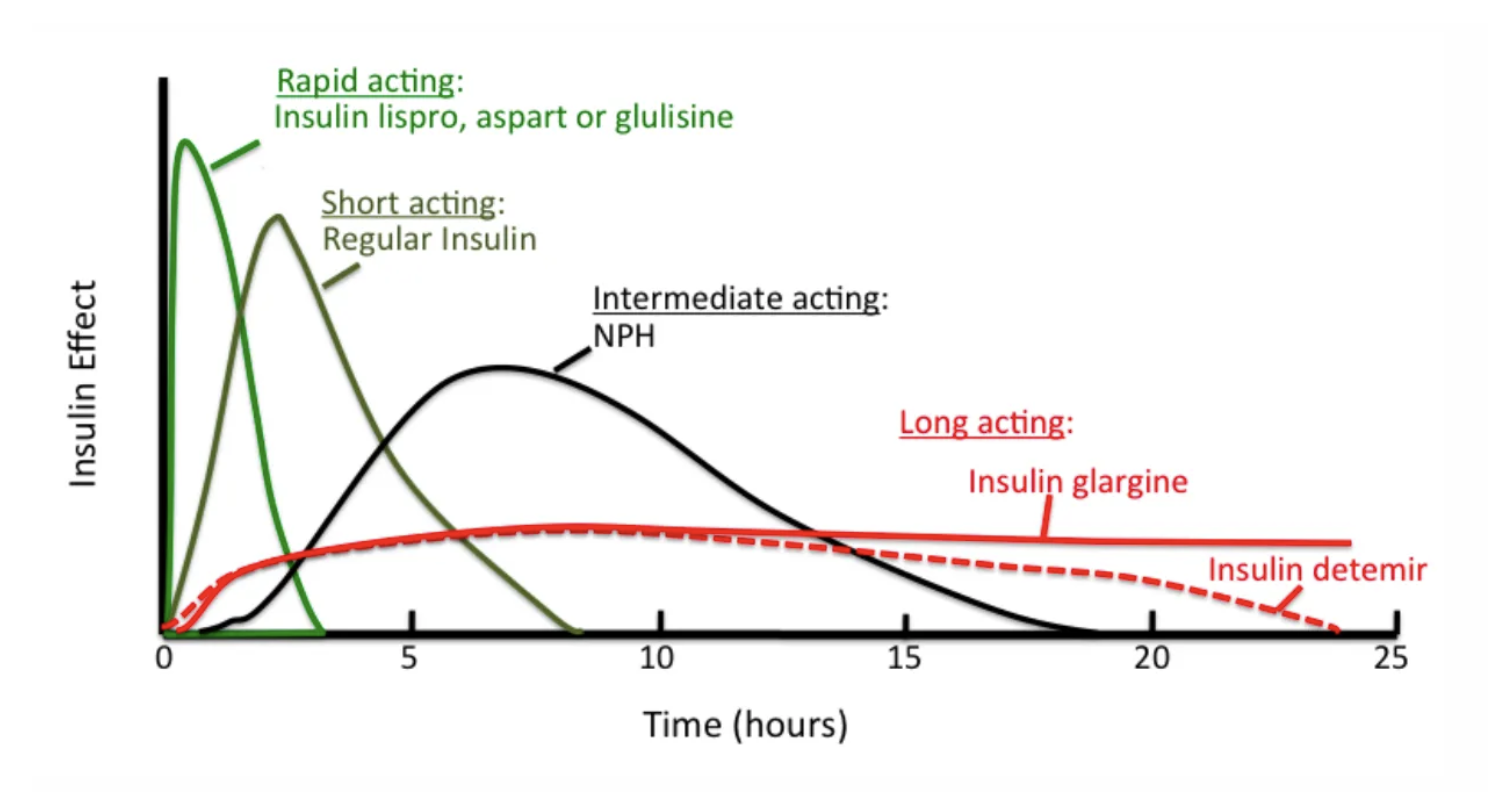

Broadly speaking all kinds of insulin are going down in price. The big distinctions are between brand names vs generics and short-acting vs long-acting insulin (many people need both kinds to manage their sugars during the day and overnight when sleeping). For reference, below is a very classic image explaining the different types of insulin and how long they act. Traditionally, people have a long-acting insulin (i.e basal insulin) that they take at night to keep their sugars low overnight and throughout the day and then add on short-acting insulin (i.e. bolus insulin) to counteract glucose spikes (e.g. when you eat). But this isn’t an endocrinology blog so that’s all the medicine you’ll get out of me.

If we break down insulin pricing changes by company it looks like this:

- Eli Lilly will reduce the price of Humalog (branded fast-acting insulin) by 70%. They will also reduce the price of Lispro (generic fast-acting insulin) to $25 a vial from $82 a vial. Further, they will launch Rezvoglar (long-acting insulin) for $92 per five pack of injectable pens, a 78% discount to Lantus (competitive long-acting insulin). They will also cap monthly cost to $35 if you go to a retail pharmacy and have a separate website for uninsured patients to receive insulin at $35 a month cap as well.

- Nova Nordisk is following a similar pattern. They will reduce the price of NovoLog (fast-acting insulin) by 75% and the prices of Novolin (intermediate and fast-acting, depending on specific type) and Levemir (long-acting insulin) by 65%. They will also lower prices of generic insulins to match the pricing of the branded insulins.

- Sanofi will cut the price of Lantus (long-acting insulin) by 78% and place a $35 cap on out-of-pocket costs for patients with commercial insurance.

All that to say that insulin prices are going down, and by a significant amount, which is definitely a huge win for large populations of patients who are reliant on insulin but haven’t been able to afford the crazy price hikes that we have seen over the years.

But this begs the question, why now?

Let’s Get Wonky

Before getting into all the wonky health policy stuff, let’s take a minute to acknowledge that a lot of this work to change insulin pricing and legislation has been due to countless hours of advocacy done by patients, families, and community members. Yes, there are legislative reasons why all of this is happening now but without the advocacy and the voices, we wouldn’t get to a place where this legislation would have even existed in the first place. It’s easy to attribute changes in the system to economic and financial incentives, but we always have to remember the underlying efforts that got us here in the first place.

Okay, that’s my rant now let’s talk policy.

There are two key pieces of legislation that have influenced the insulin market: the Inflation Reduction Act and the American Rescue Plan. Ironically, these actually just touch Medicare and Medicaid respectively and don’t have any implications on the commercial market. However, as we’ll see very soon, impacting those two areas is enough to push pharma companies to change pricing for everyone.

Let’s start with the Inflation Reduction Act. This legislation limits monthly cost-sharing for insulin to a cap of $35 but only for those who have Medicare. It does not impact people with commercial insurance or without insurance. However, because of this there was a ton of pressure and bad PR faced by the pharma companies since this essentially meant that a portion of the population was able to get reduced prices while others were still left in the dust. This was a key move to get pharma companies moving but it wasn’t enough for them to give up and reduce prices.

That brings us to the American Rescue Plan. This was policy from 2021 that made drug companies pay a rebate back to Medicaid if the price of a drug went up faster than inflation. It gets a little complicated but the way it works is that Medicaid gets a baseline rebate plus an inflation rebate on every drug. The baseline rebate is set to 23.1% (though it can be higher because Medicaid is entitled to the “best price” a manufacturer gives to any private payer) and the inflation rebate is an additional penalty that Medicaid gets if a drug’s price increases faster than inflation.

The kicker is that the total amount of rebates that a manufacturer would have to pay Medicaid have been capped at 100% of the drug’s price. So a manufacturer could keep increasing the price faster than inflation but the inflation rebate wouldn’t go up once the rebate hit 100% of the drug’s price. The American Rescue Plan includes language that would remove this cap in, surprise surprise, January 2024 which would mean that rebates would skyrocket for manufacturers if they kept their prices super high (relative to inflation).

It’s a little easier with a tangible example so here is one from a JAMA paper by Drs. Benjamin Rome and Aaron Kesselheim:

For example, if a manufacturer launched a hypothetical drug at $10 per unit in 2000 and increased the price 15% per year, after 15 years the drug would cost $81 per unit. If the drug’s price had increased at the rate of inflation instead (which averaged 2% per year during this time), the price would be $14, yielding an inflation-based Medicaid rebate penalty of $67 per unit ($81 minus $14). Added to a baseline rebate (23.1%) of $19 per unit, the total rebate of $86 per unit would exceed the drug’s price in year 15. Currently, the maximum rebate in this situation would be $81. With the elimination of the rebate cap, however, the drug’s manufacturer would owe state Medicaid programs $5 per each unit prescribed. Because of the best-price rule, many drugs have baseline rebates substantially higher than 23.1%; combining the inflation penalty with a 50% baseline rebate, the total rebate would exceed the drug’s price under less stringent assumptions, including annual price increases of 10% after 10 years.

You can see now why drug companies have a huge incentive to reduce their prices. Even though Medicaid only makes up a portion of the population that they are serving, the additional rebates would be a huge financial hit for these companies and so they essentially had no other choice than to lower their prices.

The advocacy work definitely helped, but if your question was why are all these companies doing this right now - well, here is your answer.

A Word on PBMs

The pharma / PBM wars have always been a thing and insulin pricing doesn’t change that. Just to provide the full picture, pharma companies say that the reason for their price hikes over the years is in part due to rebates that they have to pay to PBMs for favored placement on formularies. The PBMs act as the middlemen in maintaining the list of medications covered by insurance and to get a good spot on that list the drug companies have to pay rebates (i.e. fees). Because the rebates keep going up, the prices of the drugs keep going up and you’re stuck in an infinite loop of price increases. Pharma companies say that their net prices (prices after the rebates and discounts given to PBMs) have actually been going down over time.

This definitely varies for different drugs and drug manufacturers but it is an important point. Though pharma companies should be monitored to not egregiously raise their prices and leave people out, PBMs should also have similar policies in place. PBMs act as an intermediary to begin with so that insurance companies can outsource the work of maintaining formularies, but they also produce a large cost on the entire system, one that is often overlooked since most people think about insurance companies and pharma companies directly. In order to make actionable change, we need to focus on all areas where efficiency is lacking, and PBMs are definitely a part of that.

Where Do We Go From Here?

It’s going to be interesting to see how all of these policies actually take effect and what impact it has on costs and access for insulin for patients. A cap of $35 is good but many critics want even more reductions, including Bernie Sanders who wants a cap of $20 per vial of any kind of insulin.

It’s also important to think about the overall landscape for these companies, especially with the rise of other drugs like GLP-1 agonists that are now being marketed more and more heavily for weight loss. This may be a bet that pharma companies make from a macro prospective to bring in revenue as they move away from relying on insulin in the way that they have in the past, especially since they have to reduce prices to not get hit with rebates and because they continuously face pushback and fees to PBMs.

One good thing that is happening is an investigation into the practices of PBMs by the House Oversight Committee. We’ll see what comes out of it, but regulation at all levels of the pharma ecosystem is needed to ensure that we can provide drugs at appropriate prices to the patients that need them.

That is, until single payer and government drug pricing negotiation become a reality of course!

Sources: