The Future of Weight Loss Management Companies

It's not all GLP-1s

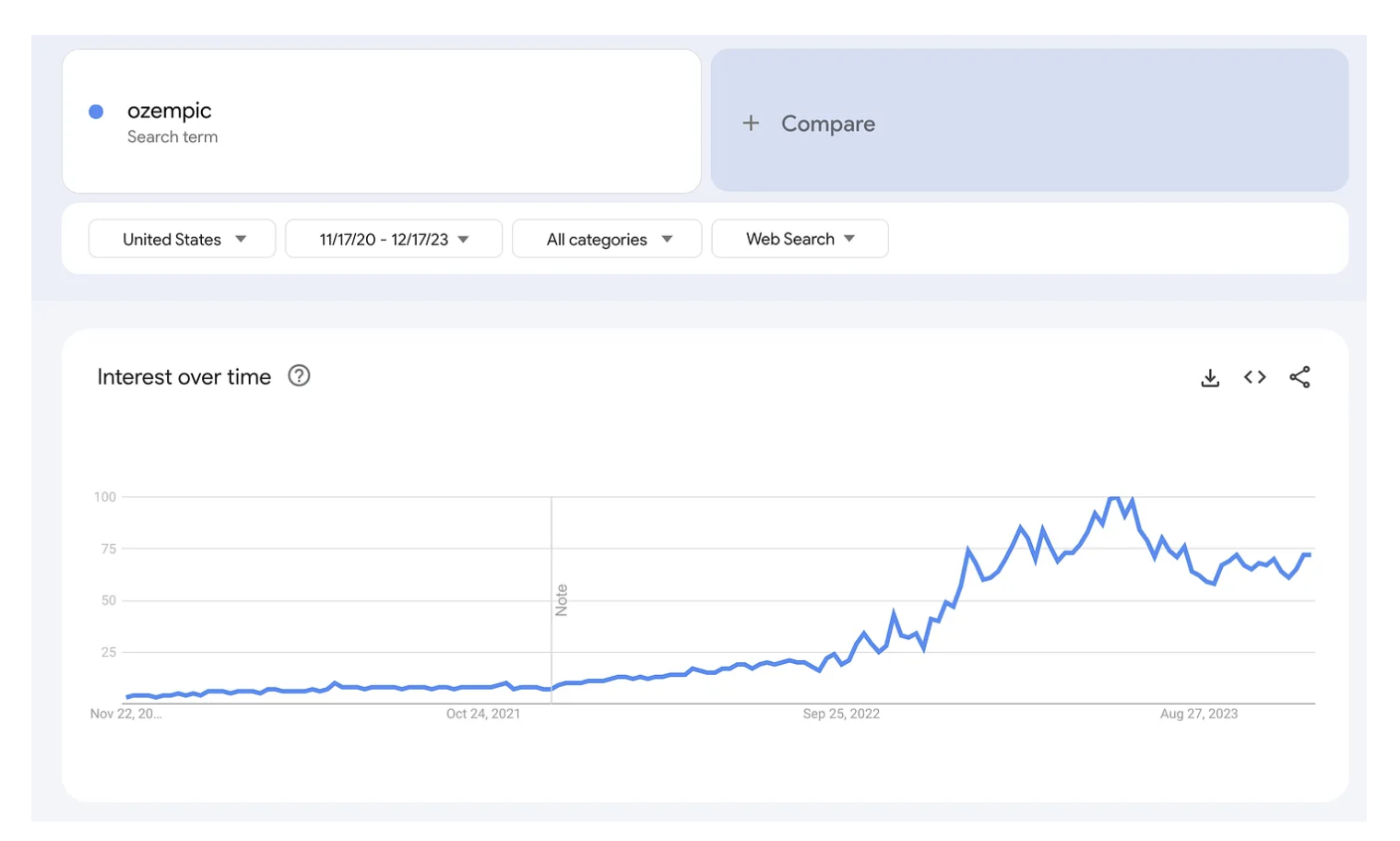

2023 has been the year of GLP-1s. Breakthrough studies have shown their benefits for diabetes, cardiac disease, and obesity. This has sparked a gold rush, and companies are realizing that there are many dollars to be made by becoming suppliers of a wonder drug that can deliver something that so many people want - the ability to lose weight by taking a drug. We’ve all seen the Tiktok videos and celebrity endorsements for Ozempic that have propelled GLP-1s into the national conversation.

The big question is whether this is sustainable. We’re seeing less VC engagement in backing companies aspiring to dispense GLP-1s. Perhaps it’s the fear of companies turning into the next Cerebral or, more likely, because these drugs are still very expensive and lack evidence that people can discontinue them and maintain weight loss, effectively turning them into cash drains in the long term. Moreover, we’ve encountered numerous supply chain issues with high demand causing companies to over-promise and under-deliver, and in some cases, like Calibrate, threats of facing bankruptcy.

A Quick Aside on the Status Quo

I want to talk about examples of models that can potentially work in this space as companies aim to capitalize on obesity management. However, let’s briefly address the issue of cost and access for GLP-1s. Currently, investors are hesitant to support more GLP-1 dispensing companies, occasionally branding them as “drug factories.” This hesitance may seem moralistic, but it’s probably due to the high cost of these drugs, which individuals may need for an extended period, if not indefinitely.

Additionally, access issues affect both individuals seeking these drugs for weight loss and those requiring them for diabetes management. Several of my patients with diabetes struggled to obtain Trulicity (another GLP-1) as many pharmacies were out of stock due to so much more demand to use it for weight loss.

I think this will likely be a short-term issue. Supply chain problems will be resolved and costs may come down (who knows maybe even the government could step in and subsidize these medications). If costs decrease, I don’t see why having to be on these medications for the long term would be an issue. We see this with many medications (like statins) and, over time, it could become normalized for drugs like GLP-1s.

How to Build a Weight Management Company

There are several different models that could be in place for a successful weight management company. The primary decision is whether to prescribe drugs. Currently, there’s a surge in these types of companies due to increased interest in GLP-1s. However, the GLP-1 market is becoming more and more saturated and we are (at least in the short term) being hit with lots of supply chain and coverage issues, impacting affordability for consumers.

Ro is one of the companies going the GLP-1 prescribing route and launched a very large ad campaign throughout NYC

Until that happens, we are seeing companies prescribe other drugs instead. The biggest recent news was that Hims & Hers will initially be focusing on weight loss by prescribing medications like metformin and buproprion with the plan of eventually rolling out GLP-1s when supply and cost operations improve. This is a fantastic play for them to strike while the iron is hot and cash in on the market momentum that GLP-1s have created. These medications are more accessible and cheaper (though getting through Hims & Hers directly will still likely be a lot more than getting them through a PCP using insurance). Starting with these drugs lets them test an entire weight management program to later incorporate GLP-1s when feasible.

No Drugs, No Problem

There are plenty of companies that want to impact the weight management space but don’t want prescribe weight loss medications. Omada Health, an OG in the digital health space, is intentionally avoiding the route of prescriptions but will support members who are on medications. The idea behind this is that they want to sit as a layer on top of a patient’s PCP and provide them with additional resources and support from care teams to work on their weight loss. That’s the key value they provide and assuming the prescriber role could further fragment patient care from both patient and provider perspectives.

Many companies are adopting this approach—working as add-on services or products for weight loss. This strategy is effective because it can be direct-to-consumer but also offers partnership opportunities with payers and providers, potentially leading to risk-based arrangements.

Outside of digital health companies like Omada, others focus on remote monitoring (e.g. CGMs) or metabolic health (Levels or Lumen). These often feel like one-off product companies rather than comprehensive care solutions, but you can see a world where consumers may select services that suit their specific weight management needs.

Payers & Providers

The trend in tech that we see a lot is companies get built and then look to sell to payers and providers. However, an interesting proposition is for payers and providers to build these services themselves (directly or via acquisition). This is of course a tougher task and impractical for smaller players due to the economics and specialization required.

But a world exists where a major academic hospital or a vertically integrated provider system (e.g. Kaiser) might benefit from developing and providing this service on their own. This could become more enticing to build as more data reveals GLP-1s’ greater impact on chronic conditions such as diabetes and cardiovascular health. Providers already possess the complete patient picture and manage their other medications, so incorporating an improved weight management program could impact many patients and ultimately improve health and reduce long-term costs. Not to mention that patients may go from one insurance plan to another, but if they stay with the same provider long-term then the provider can get the benefit of reducing future costs by managing these patients today.

This is of course very theoretical and hard to model, but not implausible. It might be a perfect project for General Catalyst’s new technology-first hospital system.

Fitness Companies and Gyms

When I first learned that Lifetime Fitness was working on a pilot program to prescribe GLP-1s to members, I couldn’t believe that the same place that doubles as a gym and a spa would also be where you could go to get your GLP-1 so that you could do more spa and less gym.

Jokes aside, physical gyms and fitness companies could be a viable option for the introduction of weight management programs, with or without prescriptions. This may be a BD play by some of the companies we talked about above but larger companies could benefit from creating their own in-house solution. Companies like Soul Cycle or Barry’s Bootcamp already have the target consumer in their sales CRM. Adding on a weight management product sounds like a natural step that could work.

It’s unlikely that many of these companies will build their own products due to the time and resource demands, but selling to these companies should be a priority for companies in the space who are looking to get marketshare outside of the more traditional avenues of providers and payers.

Some Parting Thoughts

The weight management space has significant room for growth and innovation with an increasing number of companies exploring and investing in it. One thing to keep in mind with these products is that many of them impact the longer term arc of a patient’s health. The idea is that weight loss and management today can decrease chances of bad sequelae down the line. The issue with this approach is that payers may not see the benefit of bending this risk curve if a patient leaves their plan.

We’ve seen this before, but it’s even more evident as we shift toward care interventions that are focused not just on high acuity patients and managing their costs but also patients who may be relatively healthy today yet at risk of higher costs in the future.

We may need to reassess payment models to accommodate the long-term impact of weight management interventions and consider patients’ risk scores over extended periods, rather than solely focusing on their annual risk score.