Amazon’s Health Ecosystem

You thought Apple was the only one who could build a fortress?!

In the midst of a busy JPM where water costs $45, Amazon announced that it’s launching a new Health Conditions Program with the goal of helping customers discover and enroll in virtual care benefits through their health plan. Omada Health, one of the OG digital health companies that uses data-driven behavioral coaching to improve the health of patients with diabetes, hypertension, and musculoskeletal conditions, will be Amazon’s first partner. This is big news because we see again how Amazon is taking a larger and larger foothold in the healthcare space and building out an entire ecosystem.

The Deets

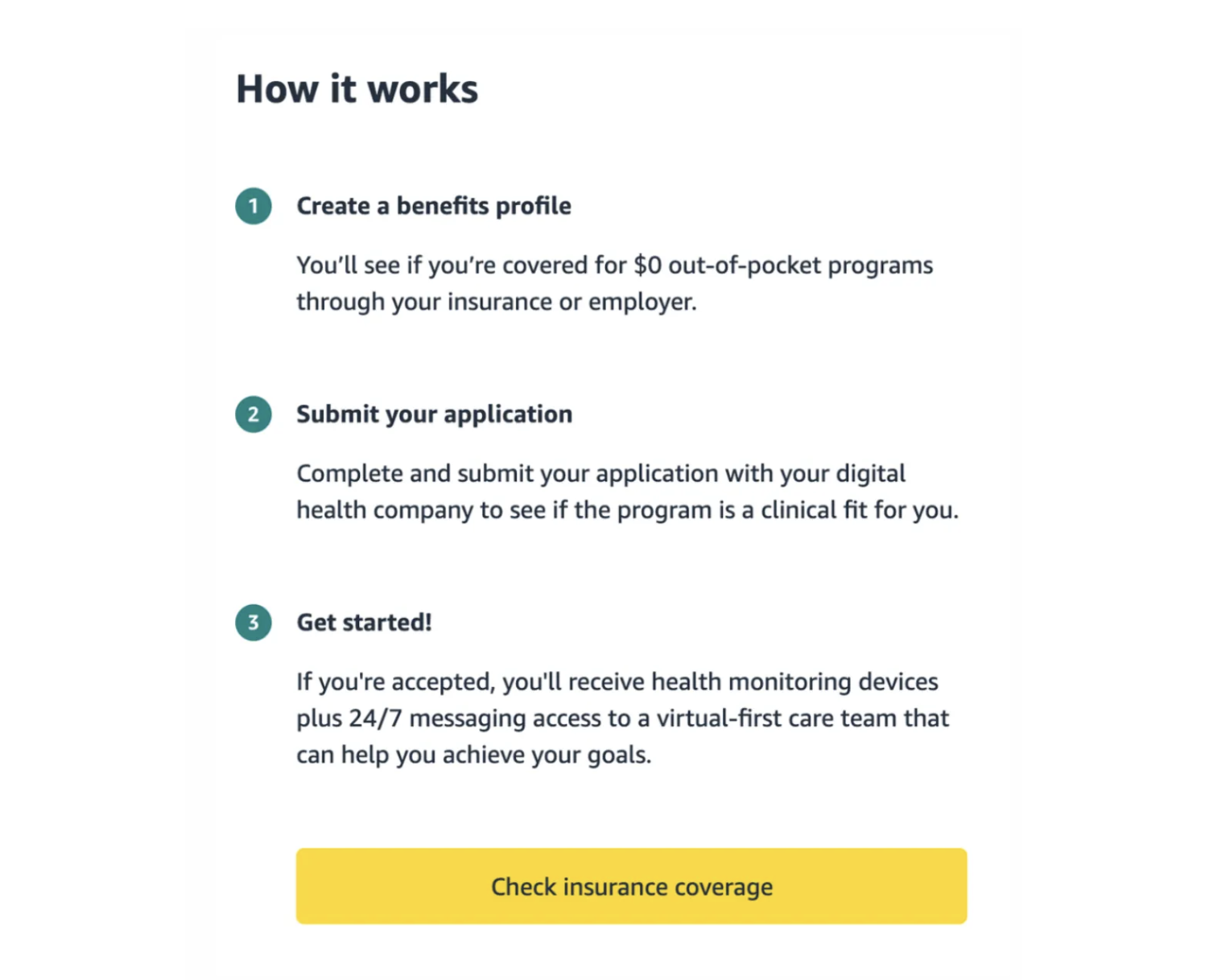

So how does it work? It’s a pretty simple process. As an Amazon user, you create a benefits profile, input your insurance information, and Amazon does the rest. It looks at your insurance to see if you qualify for any Health Conditions Programs benefits, currently just Omada, with plans to expand. If they do, then they let you know and there is some data exchange between the benefit and Amazon to make it all work. If it’s covered by your insurance then theoretically shouldn’t have to pay anything and get access to your benefit.

Winners and Losers

There’s a lot to unpack in this little announcement. On the surface it’s a partnership between Amazon and Omada, but it’s also a new customer channel that will benefit many companies. As Amazon continues to grow the program and add more digital health companies, it will become one of the go to places that companies want integrate with. The benefit is clear - companies can leverage Amazon’s huge brand instead of relying on traditional marketing channels or payer and provider integrations. Being in front of Amazon’s vast user base will drive significant traffic and propel companies forward quickly. It’s a formula for hypergrowth as the platform scales.

Patients also benefit a lot by this. They already use Amazon and pay for health care through insurance or their employer. It’s no extra cost, and by sharing their insurance information with Amazon, they receive a curated collection of digital health products they may be eligible for, which can significantly impact their health positively.

This brings us to the payers. They may not be huge fans of this because ultimately it means covering more services and paying for more. This is the opposite of what any payer wants to do, but as insurers pay for more, they pass costs onto consumers and employers through higher premiums. It may even be a slight positive for payers that also find a way to show that they are one of the brands that works with Amazon.

But of course, the biggest winner is Amazon (if they weren’t then why would they do it, right?). It may not seem like a huge win for Amazon at first. After all, the digital health companies are getting all the users and Amazon is managing the logistics of decoding everyone’s insurance. We don’t know how the Omada deal is structured but even if Amazon takes a cut of the revenue that Omada gets from the partnership, it’s unlikely to be much money. So what’s in it for Amazon?

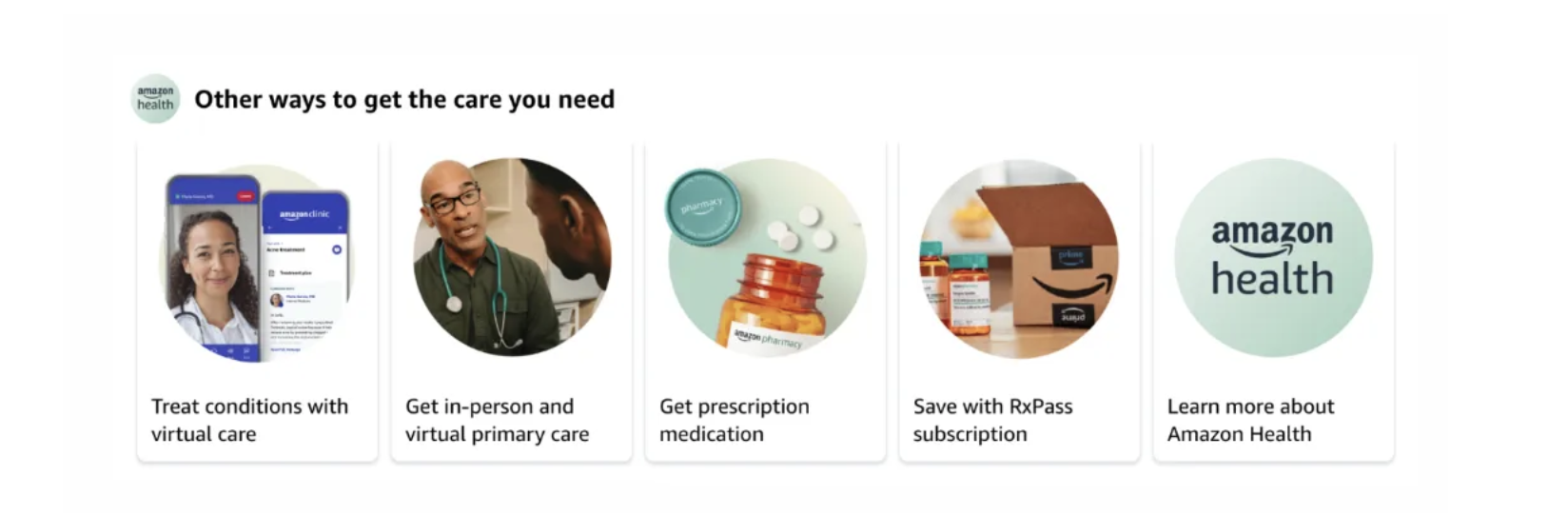

The answer is simple: ecosystem. Slowly but surely, Amazon is building an ecosystem of healthcare products to cater to all parts of a customer’s healthcare needs. We see a glimpse of it at the bottom of the Health Conditions Program website and it’s called Amazon Health.

You have Amazon Clinic for virtual care, One Medical for dedicated primary care, Amazon Pharmacy for medications, RxPass for pharmacy subscriptions, and now the Health Conditions Program to set you up with digital health products and services you didn’t even know you had access to. As a customer, you already go to Amazon for so many things so why not your health too? On top of this, the biggest thing Amazon has is your data and your user archetype. They know you well based on what you buy and how you interact with their products, and adding your health information into the mix will deepen their understanding of you. If this sounds a little scary, it kind of is.

Will Other Companies Do This?

The last thing to touch on is whether Amazon is going to be alone in all of this. The short answer is, probably not. Barring any exclusivity clauses, digital health companies are probably open to partnering with other corporations seeking to offer similar products to their customer base. We’ve seen giants like Walmart and CVS continuously trying to enter the primary care space and be more involved with patient care. Adding on additional services like digital health benefits is a logical next step for any of these players. Execution is a whole other thing, but these companies definitely have the scale and leverage to offer something like this and they are likely considering it following Amazon’s announcement.